2015 Year End Letter

Submitted by Kaizen Financial Advisors, LLC on January 15th, 2016I am writing to summarize market performance in 2015 and to briefly share some thoughts on the outlook for the period ahead. These days, most newspaper headlines paint a dim view of the future. Without dismissing the very real issues that we are facing around the world, I want to share why we should be optimistic about the future.

2015 Stock Market Performance

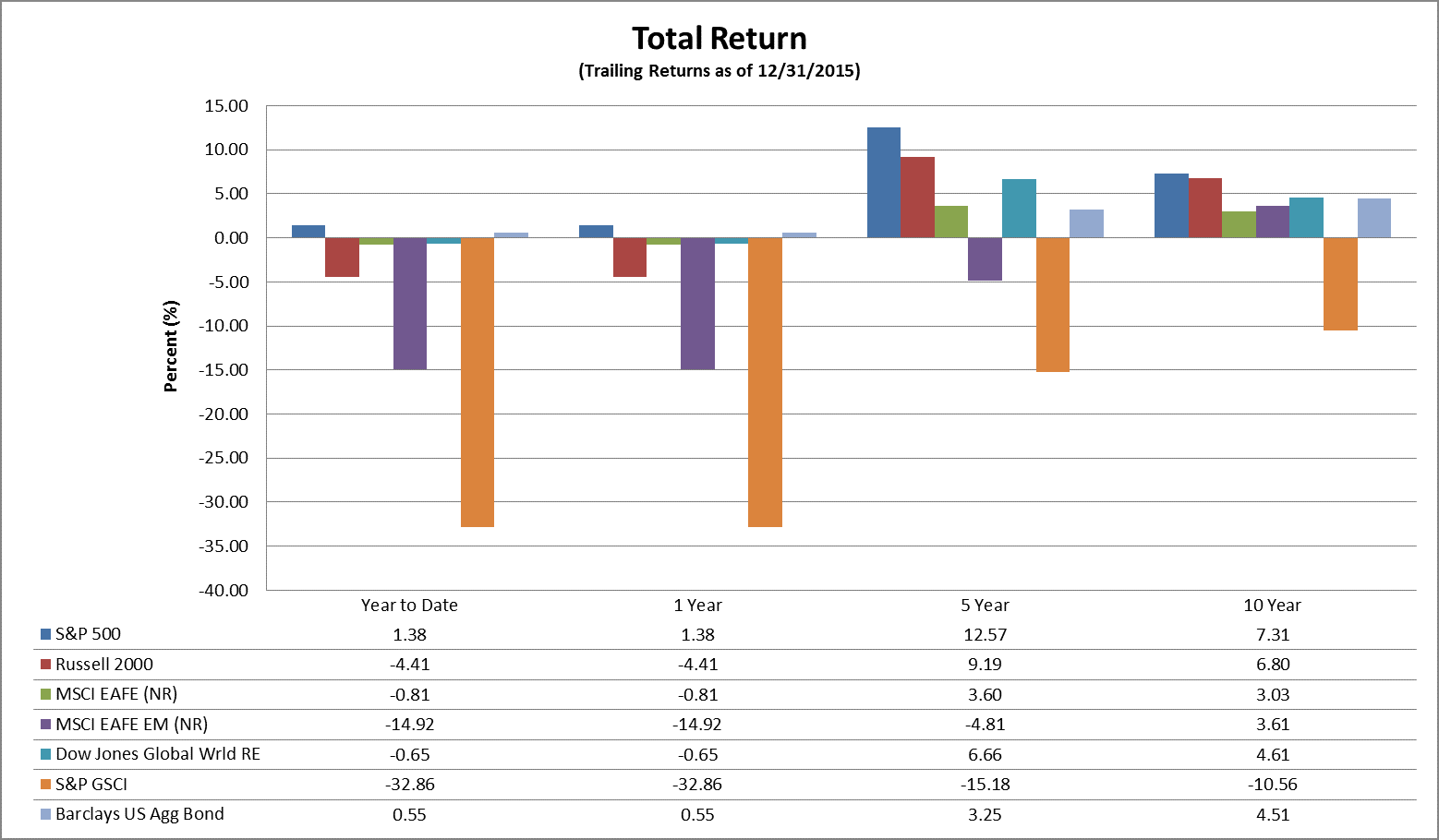

But first, here’s an overview of how last year’s markets performed. Stock prices were more volatile in 2015. After a relatively quiet first half, concerns about Chinese growth led to a sharp decline in stock prices in the third quarter followed by a recovery in the fourth quarter.

Four macroeconomic factors cast a big shadow over markets in 2015: The impact on corporate profits of oil prices that fell by over 30%; a rising U.S. dollar; uncertainty about the timing of the interest rate increase by the Federal Reserve Board that finally materialized in December; and questions about growth in China.

- Oil prices: With a sharp decline in the price of oil, the energy sector saw a sharp drop in profits and share prices for this sector fell by 26%. Other sectors whose stock prices declined were materials, down 10% as demand for minerals and other commodities declined; and utilities, which dropped by 8% in anticipation of an increase in interest rates.

- Rising dollar: The stronger dollar hurt profits in two ways: First, companies relying on exports were challenged as the cost of their goods increased in foreign markets. And second, for multinationals, the rise in the dollar led to a decline in the value of profits in their overseas subsidiaries.

- Interest rate increase: The Federal Reserve raised interest rates in December for the first time in 9 years. However, with the exception of the US high-yield, which suffered due to weakness in the broader energy complex, fixed income finished the year flat.

- Growth in China: Outside the US, concerns of slowing global growth weighed on returns. Specifically, emerging markets and commodities were the worst performers for the year, followed by developed international equities.

- Emerging markets have significantly underperformed developed markets. Uncertainty is caused by slowing economies (especially China), deleveraging of debt, and rising US interest rates. One thing to keep in mind while evaluating emerging markets looking longer-term—both backwards and forwards—is that emerging markets look like much more promising investments. Since it was launched in early 2003, the MSCI Emerging Market ETF has gained 172% (including the recent swoon) versus a 96% gain for the S&P 500. Looking forward, most emerging market countries appear to have much greater growth potential than the developed countries, and right now the valuations on many emerging market stocks are approaching historically low levels.

- In commodities, supply has outgrown demand, which has led to significantly lower prices – that’s Economics 101. It is important to note that demand for oil continues to grow; however, with improvements in technology, and the US coming online, supply from major energy producers has risen dramatically. Some have speculated that the continuation of the decline in oil prices may have been accelerated by a Saudi Arabian attempt to flood the oil markets as a strategy to put American frackers out of business.

- International developed equities actually did well in 2015 in local currency terms, but when translated back to US dollars they registered a loss for the year. In Europe, earnings are growing, unemployment is falling, and credit is expanding. All those are potentially positive signs for the region.

What’s going to happen in 2016?

Looking backward is only helpful to the extent that it helps provide perspective on the future. And today there is no shortage of worries about the period ahead.

This was crystallized in the first week of January, when bad news about the Chinese economy and a drop in the value of the Chinese currency led to a 10% decline in stock prices in that country. This led to declines in stock markets around the world, with the U.S. market down by 6%, its worst start on record. And with indications that demand for oil will continue to soften, its price, after a sharp drop in 2015, was off by another 10%.

But it’s not just weakness in the Chinese economy that is causing concerns. Scan the headlines and here are some of the things you’ll read about:

- Stalled global economic growth almost everywhere outside the United States, with continued woes in Europe and countries like Brazil;

- Continued uncertainty about whether the European Union can remain intact, with a vote this year in Great Britain about a “Brexit” from the EU;

- Political turmoil, with Russia flexing its muscles and unrest in the Middle East and Africa, leading to record numbers of migrants and refugees;

- The rise of religious zealotry and terrorism with Western institutions coming under attack; and

- Rising deficits and debt levels in many economies around the world, at the same time that aging demographics and demand for pensions in developed countries will put pressure on spending.

Add to this concerns about the impact of global warming and questions about the leadership in Washington and it’s no wonder that pessimism reigns in many corners.

Why I’m optimistic

In the face of this, there are three reasons why I am optimistic about the future: Some short-term good news, some mid-term positives, and the fact that we’ve overcome tough challenges in the past.

First, here are some reasons to be optimistic in the short-term:

- The U.S. economy is strong: The increase in interest rates in December reflected a U.S. economy that is showing real strength. A report released at the beginning of the year showed that almost 3 million new jobs were created in 2015, while unemployment dropped to 5%, half the level that we saw as recently as 2009. For 2016, the International Monetary Fund forecasts growth in the U.S. economy of 2.8%, first among the major developed economies.

- Low oil prices boost consumer spending: While declining oil prices hurt oil producers, they provide consumers with a big lift. Lower oil prices will help fuel consumer spending around the world and will be especially positive in oil-importing countries in Europe, Asia, and South America.

- A recovery in corporate profits: The impact of a stronger dollar and low oil prices is already reflected in 2015 profits. Provided that we don’t see more declines in oil or more strength in the dollar, the negative impact on profits is behind us. Current forecasts are for profit increases by U.S. companies this year of over 7%.

- Retirees are happy: This Wall Street Journal article explains why most Americans in retirement are happy with their situation.

Second, there are also reasons to be optimistic looking out beyond this year:

- Better leadership in key developing countries: The difficulties in Brazil and China obscure positive developments when it comes to new leadership in countries like India, Argentina, Nigeria, and Tanzania that will unleash the potential of young populations. The 2014 election of Narendra Modi as Prime Minister of India is particularly promising, as an economy that has been a chronic underperformer is starting to turn around. In the next 10 years, India will surpass China as the world’s most populous country, so what happens in India matters to the rest of the world.

- A big drop in global poverty: According to a World Bank report the percent of the world’s population living in extreme poverty has declined to 10%, down from over 35% in 1990. That’s a huge increase in the number of people that can afford to send kids to school and that offer the promise of entry into the middle class. This video shows the remarkable strides that have been made in reducing malnutrition, in providing access to electricity, and in aspiration to educate children and, in particular, to send girls to school.

- A reduction in violence: Contrary to popular view, global violence has actually declined over the recent past. In “The World is Not Falling Apart,” Harvard’s Steven Pinker illustrates how today compares to the past.

- Elimination of diseases: In this article, Bill Gates shares the top six good news stories of 2015, including the elimination of rubella (German measles) in the Americas and a 12-month period in which there were no new cases of polio in Africa.

Other reasons for optimism relate to the impact of technology. Peter Diamindis is an entrepreneur with degrees in engineering from MIT and from Harvard Medical School. Here’s an excerpt from the New York Times review of his book Abundance: Why the Future is Better than You Think on four reasons to be positive:

- Our technologies in computing, energy, medicine, and a host of other areas are improving at such an exponential rate that they will soon enable breakthroughs that we now barely think possible.

- These technologies have empowered do-it-yourself innovators to achieve startling advances – in vehicle engineering, medical care, and even synthetic biology – with scant resources and little manpower, so we can stop depending on big corporations or national laboratories.

- Technology has created a generation of techno-philanthropists (think Bill Gates) who are pouring their billions into solving seemingly intractable problems like hunger and disease.

- We have what Diamandis calls “the rising billion.” These are the world’s poor, who are now (thanks again to technology) able to lessen their burdens in profound ways. “For the first time ever,” Diamandis says, “the rising billion will have the remarkable power to identify, solve, and implement their own abundance solutions.”

My final reason for optimism is that we’ve successfully overcome tough challenges in the past. In the 1970s we saw runaway inflation and double-digit interest rates. In January of 1990, Saddam Hussain had seized Kuwait and we were waiting for the West to formulate a response; meanwhile, we were simultaneously dealing with sharp increases in oil prices at a time when the U.S. was dependent on imported oil and the collapse of the savings and loans industry in which almost a third of those institutions would ultimately close. Finally, in the depths of the great financial crisis, in early 2009 there was a broad view that there was a 20% chance of a global depression.

None of this is to dismiss the real issues that we are facing today. But there are solid reasons to adopt a positive outlook and to believe that we will work our way through the current challenges, just as we’ve worked through serious challenges in the past.

What this means for your portfolio

Having outlined the reasons that I’m positive for the mid-term, I recognize that 2016 seems like a particularly uncertain time. To help navigate through that, here are, once again, the three core principles that we employ in constructing portfolios: Diversification, maintaining balance, and risk management.

1. Diversification

Diversification doesn’t just mean holding stocks and bonds; it also means ensuring that within a portfolio, there is broad exposure across industry sectors and economies. By most metrics, at the start of the year, U.S. stocks are slightly pricier than their historical averages. This doesn’t mean that stock prices will collapse, but it does call for caution. Looking for other opportunities outside the US has decreased risk and increased return over time.

2. Maintaining balance

A key lesson from successful investors is the importance of not just starting with a diversified portfolio but maintaining that diversification as markets rise and fall. As a result of the strong performance by U.S. stocks over the past three years, chances are that unless there has been action taken to reallocate funds along the way. That also applies to countries, industry sectors, and individual stocks – we are believers in “taking profits” of the best performers, to avoid an overweighting that can lead to greater downside risk than was built into the original portfolio.

3. Controlling risk

We design portfolios with the view of providing clients with the best possible returns on a risk-adjusted basis when looking across a full-market cycle. To do that, we look at the broadest possible range of alternatives, both within the United States and around the world. Ultimately, every client’s needs are unique, and we work hard to develop the portfolio that is right for your personal risk tolerance and situation. If you needed cash in the next few years, it is available and not invested in the broader stock markets just for times like these.

Client Reviews

If we haven’t talked recently, we will be contacting you to set up your client review. At this meeting we will review your net worth and investment results, progress towards your goals, and any new goals for the upcoming year. I will also update your Investment Policy Statement and check in on your risk tolerance. These meetings take place starting in February. If you need to talk with me sooner please feel free to reach out and we can accommodate your schedule.

Lastly and most importantly, in moments like these, investors should not panic and overreact to the headlines. Instead, they should take the long view of stock market investing. Impulsive selling now can lead an investor to try to time the market later, and markets often punish those who try to outsmart them. For those of you still accumulating and saving, if the market goes down in the coming year, it will mean that you will be able to buy stocks at cheaper prices in anticipation of the next rise—whenever and however it arrives.

Sources:

Wilshire index data: http://www.wilshire.com/Indexes/calculator/

Russell index data: http://www.russell.com/indexes/data/daily_total_returns_us.asp

S&P index data: http://www.standardandpoors.com/indices/sp-500/en/us/?indexId=spusa-500-usduf--p-us-l--

http://www.tradingeconomics.com/united-states/unemployment-rate

Nasdaq index data: http://quicktake.morningstar.com/Index/IndexCharts.aspx?Symbol=COMP

http://www.nasdaq.com/markets/indices/nasdaq-total-returns.aspx

International indices: https://www.msci.com/end-of-day-data-search

Commodities index data: http://us.spindices.com/index-family/commodities/sp-gsci

Treasury market rates: http://www.bloomberg.com/markets/rates-bonds/government-bonds/us/

Aggregate corporate bond rates: https://indices.barcap.com/show?url=Benchmark_Indices/Aggregate/Bond_Indices

Aggregate corporate bond rates: http://www.bloomberg.com/markets/rates-bonds/corporate-bonds/

Muni rates: https://indices.barcap.com/show?url=Benchmark_Indices/Aggregate/Bond_Indices

http://www.wsj.com/articles/chinas-stock-market-still-a-draw-after-tumultuous-year-1451303164

http://www.bloomberg.com/news/articles/2015-12-31/here-are-the-best-and-worst-performing-assets-of-2015

http://www.theworldin.com/article/10632/unsettling-year-markets