Market Dip: Heart Burn or Heart Attack?

Submitted by Kaizen Financial Advisors, LLC on February 5th, 2018

To say the markets have been anything, but stellar over the past years would be an understatement. 2018 marked the first time the Dow crossed 26,000 and last year the Dow gained a whopping 28%. Congress recently gave corporations the largest tax reduction in history which should continue earnings growth. The Conference Board’s index of the 10 leading economic indicators is at its highest level in decades and pointing to economic expansion in the months to come. There are virtually no signs of a near-term recession. Nearly every developed economy in the world is currently experiencing economic expansion (a rarity), and both consumer and business confidence indexes are at the highest levels in years. What could rain on our parade?

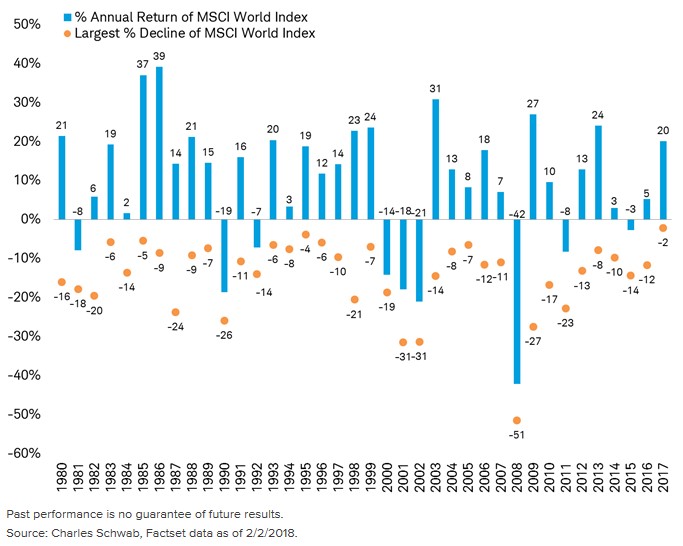

Even with all the good news listed above, the past week’s decline is a reminder the markets can be unpredictable and volatile. The Dow fell over 8.5% over the past 6 days. Is this recent volatility indicative of a bear market? We don’t think so based on the indicators mention above, but no one knows for sure. It is important to remember that significant down turns are common. Going back to 1979, global stocks have fallen more than 10% intra-year in most years despite that fact that over 76% of those years produced positive returns on a full year basis (see chart below).

It is also important to remember is that we have designed your portfolios appropriately to ride through the next downturn. Your portfolio allocation is a direct reflection of your Risk Tolerance and Risk Capacity.

- Risk Tolerance is limiting risk to a level that allows you to sleep at night without feeling compelled to sell when markets are down.

- Risk Capacity involves, matching your investment time horizon to your anticipated needs and making sure that you are not taking more risk than you have the capacity to handle based on your needs.

Wouldn’t it be nice if we could avoid the downturn all together and simply sit on the sidelines? It’d be fun to grab some popcorn and watch everyone else ride the roller-coaster. This is referred to as “Market Timing”, and while it’s an intriguing concept, it has never been a good strategy. To be a successful Market Timer you need to be right twice: first when the market is very high and second when the market is very low. The inevitable time lag of information means it will be too late by the time pundits and news sources have confirmed the bear market. By then your account value will already have declined substantially. Likewise, when the recovery finally seems underway, stock prices are likely to be much higher than where you sold. This is the track record of investors timing the market. In the long run this strategy has been costly.

If we stay the course, what might the next bear market look like? Since 1929 there have been 25 Bear Markets (20% or greater declines in the S&P 500):

|

|

Duration (months) |

S&P 500 Decline (%) |

|

Average |

10.0 |

-35.4% |

|

Median |

8.3 |

-33.5% |

|

Maximum |

21.0 (Jan 73 - Oct 74) |

-61.8% (Nov 31 - Jun 32) |

|

Recent 1 (Mar 00 - Sep 01) |

18.2 |

-36.8% |

|

Recent 2 (Jan 02 – Oct 02) |

9.3 |

-33.8% |

|

Recent 3 (Oct 07 - Nov 08) |

13.6 |

-51.9% |

|

Recent 4 (Jan 09 – Mar 09) |

2.1 |

-27.6% |

|

Source: BofA Merrill Lynch Global Research, Bloomberg |

||

From the table above, we see that a typical bear market lasts about 10 months and experiences a decline of 35%. Also interesting is that over this 88 year period, there were 25 bear markets, which means a bear market on average occurred every 3.5 years. For comparison, our current bull market which began Mar 9, 2009, is now 8.9 years old. There’s only been one longer bull market in history (Dec 87 – Mar 00), which lasted for 12.3 years.

Kaizen Clients can be confident that their long term financial goals are aligned with their portfolio allocations. As we are meeting with clients for their reviews we will be updating and assessing your current financial situation, risk tolerance, and risk capacity. If you feel your financial situation has changed or you want to review your investments sooner, please reach out to us. We are here to help you make sound financial decisions.