Mid-Terms and the Markets

Submitted by Kaizen Financial Advisors, LLC on November 2nd, 2018

Regardless of party affiliation, investors may try to gauge what will happen on election night and whether to make any adjustments accordingly. The good news, from a financial perspective, is that historically midterm elections have not had a major impact on the financial markets or provided reasons for investors to make major changes to their investment plans. It’s critical to take a step back and let history be our guide. Let’s look:

Midterm election cycles tend to be characterized by recurring themes

- In the first midterm of a new president, we generally see a significant congressional shift in favor of the opposing party to the president. This would align with the current “blue wave” expectation largely reported in the media. You may recall 8 years ago when Barack Obama was a first term president, the first midterm resulted in a 60+ House seat change in favor of the Republican party1. In addition, Democrats experienced significant losses in the Senate. In fact, 11 of the past 12 presidents experienced losses in the House of Representatives during their first midterm after being elected. The Senate losses are not as pronounced as the House because a Senators term is 6 years and only 1/3 of the seats are up for vote during a midterm. Historically however the sitting president’s party lost Senate seats in 8 of the past 12 midterm cycles1.

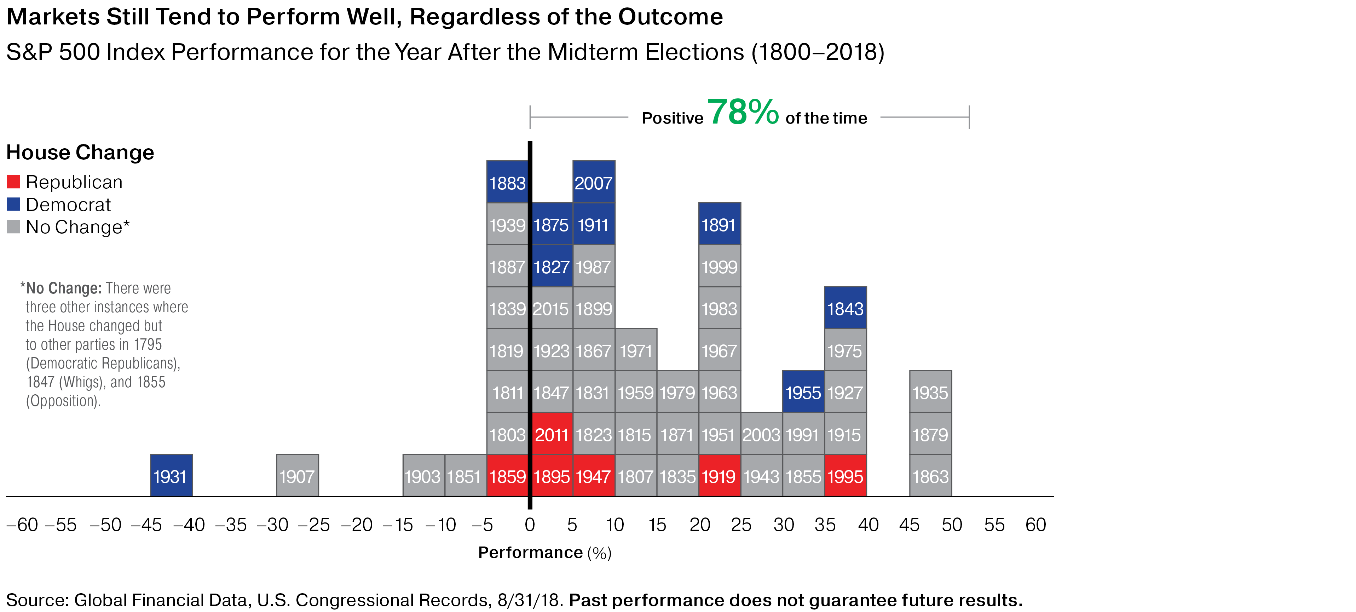

- Another recurring midterm theme involves the stock markets. Midterm elections occur every 4 years, with presidential elections occurring in between. Post-midterm election year markets have historically been among the best 12-month runs experienced by stocks. Since 1950 there have been 17 such years. The average 12-mo post-election return during those 17 years was 15.1%. The returns generated during all other years was just 6.8%. And of those 17 12-mo periods, ALL were positive, ranging between 3% and 34%3.

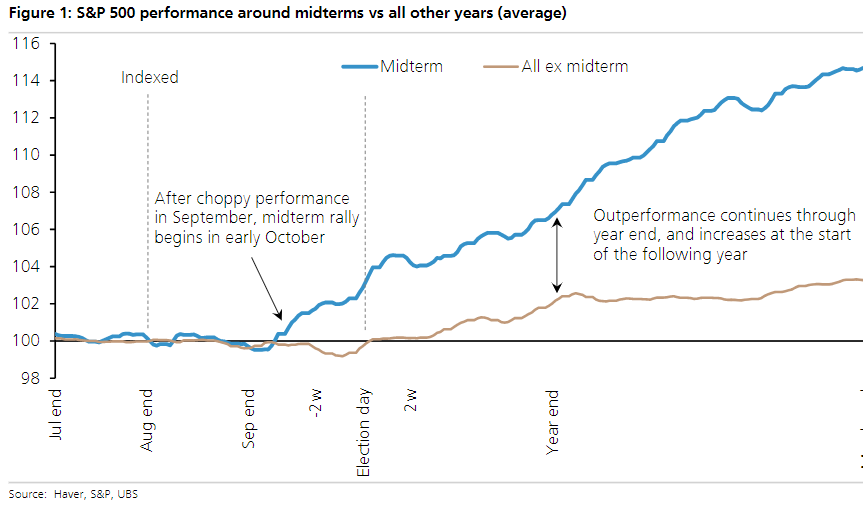

- UBS2 recently compiled some financial analytics on S&P 500 returns during midterm election cycles. The results are both interesting and significant. The time studied was July (pre-election) through the 12 months post-election day. During the pre-election July through September, the S&P was basically flat on average. Although there was a noticeable drop in the market near the end of September. This time period likely represents the highest levels of uncertainty and it’s when midterm election activity kicks into high gear with media hype at high levels.

- In October, the month before election day, markets historically begin to rebound, and marked the beginning of a longer positive run for the S&P500. It is likely that the markets have digested projected election outcomes and uncertainty has diminished. From the chart below2, you can clearly see the post-midterm election run and the pronounced over-performance compared to non-midterm election years.

- Another interesting observation is that the markets don’t seem to care which political party wins the mid-term cycle. As it stands today, most professional political analyst believe that Democrats will take over the House and the Senate will remain in Republican control. The chart below, from OppenheimerFunds1, depicts the market’s performance vs midterm elections back to 1800. If party control of the House changed in that election cycle the square is colored. Can you find a pattern by party? We can’t either. The market doesn’t seem to care which party wins in a given election cycle, but 78% of the time it has resulted in positive post-election year returns.

One factor that has changed over time is information flow. We live in a 24/7 news cycle world. News has become an entertainment industry fighting for viewers and advertising dollars. They love to stir up emotions that seem to be more intense every year. As a result, investors can become susceptible to assigning too much investment risk to election outcomes. It is important to remember that regardless of who controls the halls of Congress, corporations will continue to innovate, and make decisions that will enhance shareholder value.

In conclusion, political surprises may have short-term market implications but over the long-term they have proved to be mere blips. And while it may be exciting to talk politics, history offers compelling evidence that the current political environment should not influence investment decisions. It is human nature to think the present moment is exceptional and greatly different from anything that has occurred in the past. Markets have weathered “unique” political environments before, and history has generally demonstrated the value of developing a long-term plan and sticking to it, regardless of who is controlling Washington.

If you want to discuss this article more or your current allocation, please reach out to your advisor at Kaizen Financial Advisors.

Notes:

1Oppenheimerfunds.com: “What the Midterm Elections Mean for the Markets”, Brian Levitt https://www.oppenheimerfunds.com/registered-investment-advisors/article/mid-terms

2MarketWatch: “Will midterm elections sink the stock market? Here’s what history says” https://www.marketwatch.com/story/midterm-elections-usually-give-stocks-pause-in-september-but-pave-way-for-later-gains-2018-09-01

3Capital Ideas: “Can midterm elections move markets? 5 Charts to watch”, Capital Ideas Editorial Team, https://www.thecapitalideas.com/articles/midterm-elections-markets-5-charts