Q2 2017 Quarter End Report

Submitted by Kaizen Financial Advisors, LLC on July 21st, 2017THE QUARTER IN BRIEF

After a remarkable first quarter, the stock market cooled off slightly in Q2 – but investors still saw substantial gains. Strong earnings helped take Wall Street’s collective mind off a decidedly mixed bag of economic signals. Consumers remained confident as the quarter unfolded; although hiring, inflation, and consumer spending weakened. Home sales declined, then rebounded. Overseas, factory activity in China and the eurozone showed improvement, and foreign equity benchmarks continued climbing. Many commodities took sizable Q2 losses. When the quarter ended, the bulls were still firmly in charge and we just experienced the third-best first half, in terms of U.S. market returns, of the 2000s.

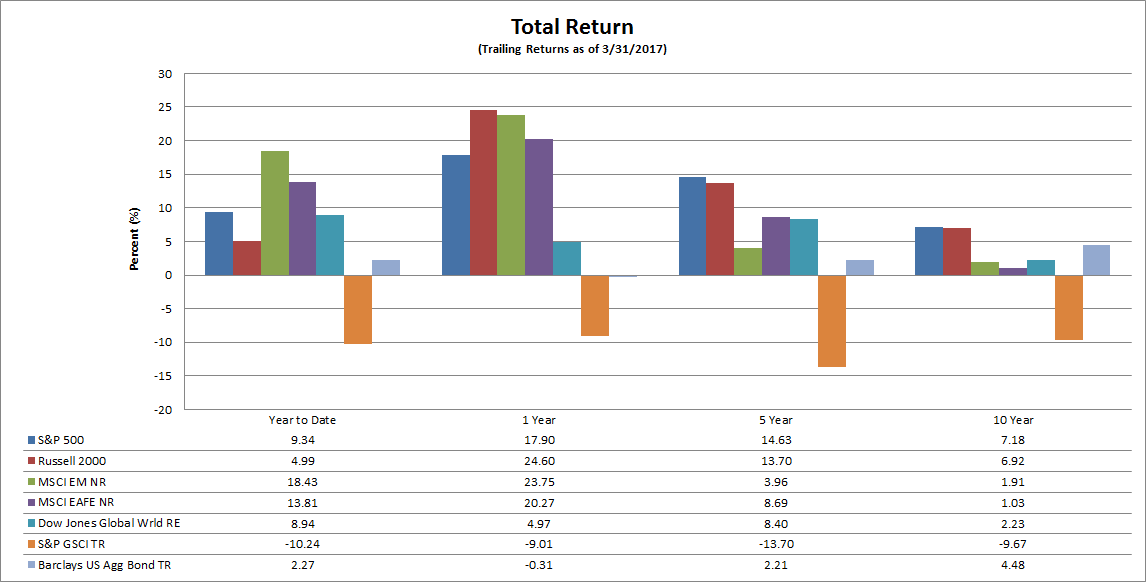

Let’s take a closer look. For those of you visually oriented, here’s a summary graph, followed by the specific details.

* Note that S&P 500, Russell 2000, Dow Jones Global World Real Estate, S&P GSCI, and Barclays US Aggregate Bond indices are reported in total return (TR), which includes all dividends reinvested, while MSCI EAFE and MSCI EAFE Emerging Markets are reported in price index (PR), which does not include dividends.

U.S. Index Performance

National markets, as measured by the S&P 500 and the Russell 2000 indices:

- The S&P 500 index posted a gain of 3.09% for the quarter and is up and is up 9.34% year-to-date.

- The Russell 2000 Small-Cap index is up 2.46% for the quarter and up 4.99% year-to-date.

Global Returns

Meanwhile, in the global market:

- The broad-based EAFE index of companies in developed foreign economies gained 6.12% in dollar terms in this quarter, and shows a gain of 13.81% for the year so far.

- Emerging markets stocks of less developed countries, as represented by the EAFE EM index, gained 6.27% for the quarter and remain up 18.43% for 2017.

Other Investments

Looking over the other investment categories:

- Dow Jones Global World Real Estate index rose 3.97% for the quarter, giving a total year-to-date gain of 8.94%.

- Commodities, as measured by the S&P GSCI index, lost 5.46% this quarter, and remains down at -10.24% year-to-date.

- The Barclays US Aggregate Bond index is up 2.27% for the year. Meanwhile, 30-year Treasuries are yielding 2.84%, up from 2.30% in June 2016, and 10-year Treasuries currently yield 2.31%, up from 1.49% at this time last year.

DOMESTIC ECONOMIC HEALTH

As one quarter ends, the Bureau of Economic Analysis commonly makes its third and last assessment of the prior quarter’s economic growth (though, even this “final” estimate may be adjusted in later years). In the last week of June, the BEA announced a “final” Q1 growth number of 1.4%, which was nothing to celebrate. Would Q2 growth come in above 2%?

Second-quarter consumer spending data from the Department of Commerce raised some concerns about reaching that percentage of growth. While April and May brought solid growth for personal incomes (0.3% in the former month and 0.4% in the latter), the gain in personal spending fell from 0.4%, in the fourth month of the year, to 0.1%, in the fifth. Retail sales, too, tailed off: after rising a robust 0.4% in April, they fell 0.3% for May.2

Households did feel good about the state of the economy and their financial prospects. At final readings of 97.0 in April, 97.1 in May, and 95.1 in June, the University of Michigan’s consumer sentiment index stayed well north of its 86.1 historical average. The Conference Board’s index ended the quarter at a very high mark of 118.9.

Hiring figures from the Department of Labor were somewhat weak. Monthly employment reports showed that U.S. firms added 174,000 net new jobs in April and 138,000 net new jobs in May. (In March, the number had been just 50,000.) Was the job market simply at capacity? Only time would tell. Reductions in the labor force participation rate helped send both the headline jobless rate and the U-6 rate, factoring in the underemployed, to notable lows. By June, the headline (U-3) rate had dipped to 4.3%, a level unseen in 16 years; the U-6 rate had fallen to a 10-year low of 8.4%.

On the manufacturing front, the news appeared better. The Institute for Supply Management’s factory purchasing manager index rose to 57.8 in June, a 34-month peak. This was after readings of 54.8 in April and 54.9 in May. ISM’s service sector PMI was also well above the expansion line of 50 in April and May, displaying respective readings of 57.5 and 56.9 in those months.

Still, federal government reports showed manufacturing and industry production falling off in Q2. Industrial output jumped 1.1% in April; then, flattened in May. Manufacturing output went from a 1.1% gain to a 0.4% retreat. Hard goods orders were down 0.9% in April; then, down 1.1% a month later.

Annualized inflation declined during the quarter. The May Consumer Price Index showed only a 12-month gain of 1.9% and just 1.7% for core prices. A month earlier, yearly inflation had been at 2.2% with the core CPI rising 1.9%. Did wholesale inflation also lessen? The headline number did, ticking down 0.1% in May to 2.4%. The core Producer Price Index was up 2.1% year-over-year through May, a 0.2% increase from April.

The Federal Reserve lifted the federal funds rate by another quarter point in June to a target range of 1.00-1.25%. It also disclosed it would begin reducing its massive bond portfolio “this year,” which could put pressure on long-term interest rates. The central bank intends to let $6 billion of Treasuries and $4 billion per month in agency debt and mortgage-linked securities mature per month to start. In late June, all 34 of the country’s largest banks passed the Fed’s annual stress tests – a milestone unseen since their adoption seven years ago.

GLOBAL ECONOMIC HEALTH

Emmanuel Macron’s decisive victory in France’s national election cheered investors concerned about the potential for another crack in the European Union, and it started a rally in the euro, which continued in June after European Central Bank President Mario Draghi commented that “the threat of deflation is gone and reflationary forces are at play.” Investors took those words as a strong hint that the ECB would presently end its quantitative easing. As the quarter concluded, Chancellor Angela Merkel’s reelection seemed probable in Germany; a fourth Merkel term would be another boost to EU economic confidence and stability.

Manufacturing economies accelerated around the world in the quarter. The Markit eurozone factory PMI reached 57.0 in May, and then, 57.4 in June (a 4-year peak). Manufacturing PMIs in Vietnam, India, South Korea, Taiwan, and Japan were all above 50 (the level signifying sector expansion) as Q2 wrapped up. China’s official factory PMI was at 51.2 in May; then, 51.7 in June. Its official service sector PMI came in at 54.5 in May and 54.9 in June.

WORLD MARKETS

One factoid conveys how well global equity benchmarks did in 2017’s first half: 26 of the world’s 30 major indices posted 6-month gains. The last time that happened was in 2009 – and it has only occurred in four other similar intervals within the past two decades.12

Germany’s DAX finished the first half up an impressive 7.4% YTD, and France’s CAC 40 was up 5.3% on the year when Q2 ended. The United Kingdom’s FTSE 100 was 2.4% higher YTD on June 30. India’s Sensex topped the 31,000 level in June, reaching an all-time peak and outdistancing nearly all of its nearby Asia-Pacific benchmarks with an astounding 16.1% first-half advance. The Nikkei Asia300 index did even better, ending the first half of 2017 up more than 21% YTD.

Looking at some regional indexes, the pan-Europe Stoxx 600 index fell 0.5% in Q2, but still had risen 5.0% YTD through June.

COMMODITIES MARKETS

Oil traded under $50 for most of the second quarter, touching a low of $42.05 before rising to finish Q2 at $46.33 on the NYMEX. Gold ended June at $1,241.40; silver, at $16.57.

Losers outnumbered winners in the commodity sector in Q2, and some commodities took steep falls. Iron ore slid 21.37% in the quarter; sugar, 17.60%; gasoline, 11.16%; coffee, 10.95%. Other notable losses came for silver, oil, and cocoa, which were all down between 9-10% for the quarter; heating oil and natural gas gave back roughly 5%. Among the big Q2 winners: oats, up 29.32%; CBOT wheat, up 19.81%; feeder cattle, up 10.43%. Palladium picked up 4.78%; soybean oil; 3.62%; corn; 1.72%; copper, 1.66%.

The animal protein and grain sectors were the best-performing portions of the commodities market in the quarter, respectively gaining 15.13% and 13.34%. The energy sector fell 7.61%; the precious metals sector, 2.09%; the base metals sector, 1.75%.

REAL ESTATE

Home buying slumped in April and then rebounded during May. In the fourth month of the year, the National Association of Realtors calculated a 2.5% decline in resales – but a 1.1% May gain left them 2.7% improved over the past 12 months. That May gain happened with inventory down 8.4% year-over-year and a median existing home price 5.8% higher ($252,800) than a year before. The Census Bureau said that new home sales dropped 7.9% in April, but they rose 2.9% a month later.

Cheap mortgages were certainly a plus. In Freddie Mac’s March 30 Primary Mortgage Market Survey, mortgage types bore the following average interest rates: 30-year fixed, 4.14%; 15-year fixed, 3.39%; 5/1-year adjustable, 3.18%. Freddie’s June 29 survey showed the following averages: 30-year fixed, 3.88%; 15-year fixed, 3.17%; 5/1-year adjustable, 3.17%.

Three other closely-watched housing market indicators weakened in Q2. The Census Bureau’s monthly snapshot of housing starts and building permits showed starts down 2.8% in April and 5.5% in May as well as permits slipping 2.5% for April and 4.9% for May. The year-over-year advance on the 20-city composite S&P/Case-Shiller home price index was 5.9% in the March edition and 5.7% in the April edition (this is a famously lagging indicator). Finally, NAR’s pending home sales index took two small steps back, retreating 1.7% in April and 0.8% in May.2

As always, there are many uncertainties to watch in the days ahead. The U.S. Congress is still debating a health care package, and has promised to revise our corporate and individual tax codes later this year. There’s an infrastructure package somewhere on the horizon, and perhaps a round or two of tariffs on imported goods. Inflation often follows when the Fed raises rates, but we don’t know if or when the Fed will do that, or by how much.

With equity indices up between 15-27% in the last 12 months, investors are naturally skeptical about how long stocks can maintain such powerful momentum. Bullish analysts see more upside to this market during the rest of 2017. Bears say that the bulls who embrace these statistics are suffering from recency bias and the run up has lasted for longer than anybody would have expected when we came out of the gloomy period after the 2008 crisis. Inevitably, we are moving ever closer to a period when stock prices will go down. However, even though many pundits try, that day cannot be predicted in advance.

Sources:

Wilshire index data: http://www.wilshire.com/Indexes/calculator/

Russell index data: http://www.ftse.com/products/indices/russell-us

S&P index data: http://www.standardandpoors.com/indices/sp-500/en/us/?indexId=spusa-500-usduf--p-us-l--

Nasdaq index data:

http://quotes.morningstar.com/indexquote/quote.html?t=COMP

http://www.nasdaq.com/markets/indices/nasdaq-total-returns.aspx

International indices: https://www.msci.com/end-of-day-data-search

Commodities index data: http://us.spindices.com/index-family/commodities/sp-gsci

Treasury market rates: http://www.bloomberg.com/markets/rates-bonds/government-bonds/us/

Bond rates:

http://www.bloomberg.com/markets/rates-bonds/corporate-bonds/

General:

https://www.ft.com/content/cb5b1156-5d9e-11e7-b553-e2df1b0c3220

https://wdef.com/2017/06/29/economy-grew-1-4-in-first-quarter-higher-than-previous-estimates/

http://money.cnn.com/2017/01/06/news/economy/december-jobs-report-2016/index.html?iid=EL