Q2 Quarter-End Report

Submitted by Kaizen Financial Advisors, LLC on July 8th, 2016This quarter continues 2016 as the year of volatility and uncertainty, what with the surprising “Brexit” vote in the UK, the dismal first few days of the year, and increased volatility across the board. So it may come as a surprise that the second quarter of 2016 eked out small positive returns for many of the U.S. market indices, and most are showing positive (though hardly exciting) gains over the first half of the year.

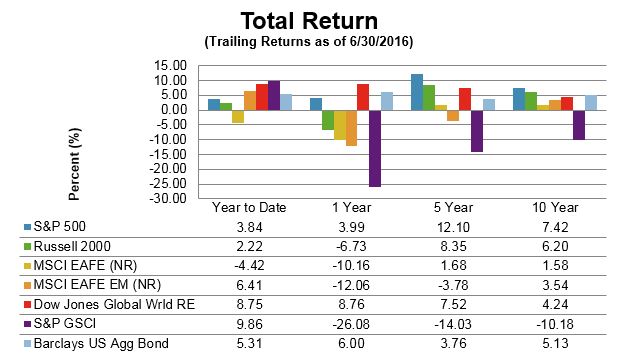

Let’s take a closer look. For those of you visually oriented, here’s a summary graph, followed by the specific details.

* Note that S&P 500, Russell 2000, Dow Jones Global World Real Estate, S&P GSCI, and Barclays US Aggregate Bond indices are reported in total return (TR), which includes all dividends reinvested, while MSCI EAFE and MSCI EAFE Emerging Markets are reported in price index (PR), which does not include dividends.

U.S. Index Performance

National markets, as measured by the S&P 500 and the Russell 2000 indices:

- The S&P 500 index posted a gain of 2.46% for the quarter and is up a 3.84% year-to-date.

- The Russell 2000 Small-Cap index is up 3.79% for the quarter and up 2.22% year-to-date.

Global Returns

Meanwhile, in the global market:

- The broad-based EAFE index of companies in developed foreign economies lost 1.46% in this quarter, and shows a loss of 4.42% for the year so far.

- Emerging markets stocks of less developed countries, as represented by the EAFE EM index, gained 0.66% for the quarter and is up 6.41% year-to-date.

Other Investments

Looking over the other investment categories:

- Dow Jones Global World Real Estate index rose 3.81% for the quarter, giving a total year-to-date gain of 8.75%.

- Commodities, as measured by the S&P GSCI index, gained 12.67% this quarter and up 9.86% year-to-date.

- The Barclays US Aggregate Bond index is up 6.00% for the year. Meanwhile, 12-month government bonds are yielding only 0.43%, and 10-year Treasuries currently yield 1.47%.

Market Analysis

On the first day of July, the Dow, S&P 500, and NASDAQ indices were all higher than they were before the Brexit vote took investors by surprise, which suggests that, yet again, the people who let panic make their decisions lost money while those who kept their heads sailed through. There will be plenty of other opportunities for panic in a future where terrorism, a continuing mess in the Middle East, a refugee crisis in Europe, and premature announcements of the demise of the European Union will deflect attention away from what is actually a decent economic story in the U.S.

How decent? The American economy is on track to grow at a 2.0% rate this year, which is hardly dramatic, but it is sustainable and not likely to overheat different sectors or lead to a recession. Manufacturing activity is expected to grow 2.6% for the year based on the numbers so far, and the unemployment rate has fallen to 4.7%, which is actually below the Federal Reserve target. Inflation is also low, running around 1.4% this year. The unemployment statistics are almost certainly misleading in the sense that many people are underemployed, and a sizable number of working-age men are no longer participating in the labor force, but for many Americans, there’s work if you want it. Historically low oil prices and high domestic production have lowered the cost of doing business and the cost of living across the American economic landscape.

Despite all this good news, the market is struggling to keep its head above water this year, and is nowhere near the record highs set in May of last year.

Questions remain. The biggest one in many peoples’ minds is: Will the European Union break up now that its second-largest economy has voted to exit? There is already renewed talk of a Grexit, along with clever names like the dePartugal, the Czechout, and the Big Finnish. There’s even been discussion about Texas leaving the U.S. With active political movements in at least a dozen Eurozone countries agitating for an exit, is it possible that someday we’ll view the UK as the first domino?

A recent report by Thomas Friedman of Geopolitical Futures suggests that the EU, at the very least, is going to have to reform itself, and the vote in Britain could be the wake-up call it needs to make structural changes. The Eurozone has been struggling economically since the common currency was adopted. It is still dealing with the Greek sovereign debt crisis, a potential banking crisis in Italy, economic troubles in Finland, political issues in Poland and, in general, a huge wealth disparity between its northern and southern members. Is it possible that a flood of regulations coming out of Brussels is imposing an added burden on European economies? Should different nations be allowed to manage their policies and economies with greater independence and focus?

Friedman thinks the UK will be just fine, because Europe needs the cohesion it brings to act as a strong trading partner. Britain is Germany’s third-largest export market and France’s fifth largest. Would it be wise for those countries to stop selling to Britain or impose tariffs on British exports? And more broadly, with the political turmoil in the UK, is it possible that there will be a re-vote, particularly if the European Union decides to make reforms that result in a less-stifling regulatory regime?

You’ll continue to see dire headlines, if not about Brexit or the Middle East, then about China’s debt situation and the Fed deciding for or against raising rates in the U.S. economy. Oil prices are going to bounce around unpredictably.

The remarkable thing to notice is that with all the wild headlines we’ve experienced so far, plus the worst start to the year in U.S. market history, the markets are up slightly here in the U.S., and the economy is still growing. Yes, your international investments are down right now, but eventually, you can expect them to come to the rescue when the American bull market finally turns.

When will that be? If we knew how to see the future, we would be in a different business. All of us are going to have to resign ourselves to being surprised by whatever the rest of the year brings us, headline by headline. You know that we at Kaizen will stay with you every step of this journey, whether up or down.

Should you have any questions regarding this analysis, or anything else financial-related, please don’t hesitate to contact us.

Sources:

Bob Veres, CA – 2016-7-1 Quarter-end Report (07/01/2016)

Wilshire index data. http://www.wilshire.com/Indexes/calculator/

Russell index data: http://indexcalculator.russell.com/

S&P index data: http://www.standardandpoors.com/indices/sp-500/en/us/?indexId=spusa-500-usduf--p-us-l--

Nasdaq index data: http://quicktake.morningstar.com/Index/IndexCharts.aspx?Symbol=COMP

International indices: http://www.mscibarra.com/products/indices/international_equity_indices/performance.html

Commodities index data: http://us.spindices.com/index-family/commodities/sp-gsci

Treasury market rates: http://www.bloomberg.com/markets/rates-bonds/government-bonds/us/

Aggregate corporate bond rates: https://indices.barcap.com/show?url=Benchmark_Indices/Aggregate/Bond_Indices

Aggregate corporate bond rates: http://www.bloomberg.com/markets/rates-bonds/corporate-bonds/

http://useconomy.about.com/od/criticalssues/a/US-Economic-Outlook.htm

http://www.marketwatch.com/story/first-quarter-us-gdp-raised-to-11-2016-06-28?siteid=bulletrss