Response To Fed Rate Hike

Submitted by Kaizen Financial Advisors, LLC on December 16th, 2016On Wednesday, the Federal Reserve Board decided to raise its rate by a quarter point this week. They based this on the current overall positive financial outlook: The U.S. economy is showing strength; the stock market is hitting new highs; and the unemployment rate has remained low. Adding fuel, the incoming administration has promised lower taxes and make significant investments in infrastructure.

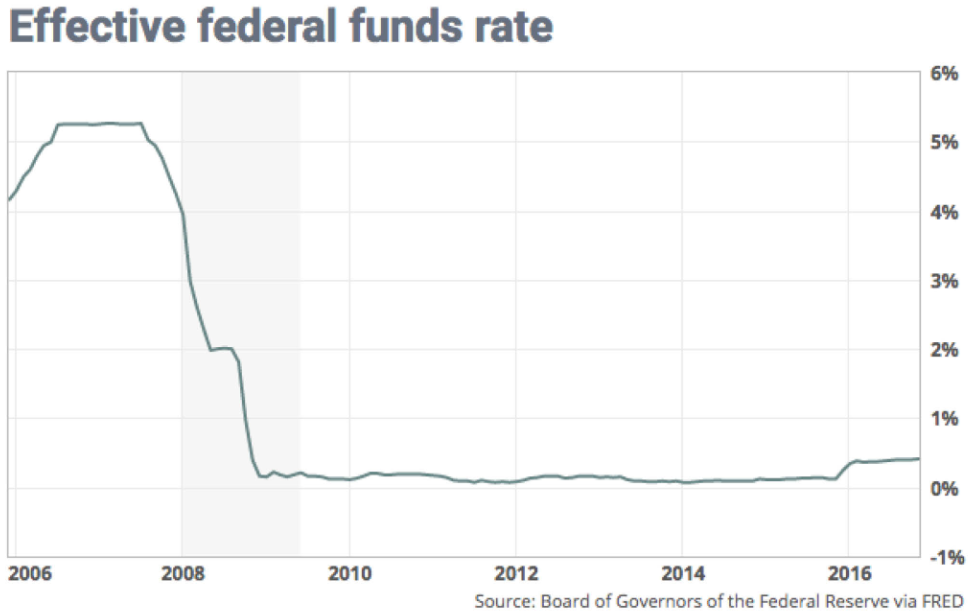

The rate rise is a conservative 0.25%, increasing the target rate from 0.50% to 0.75%—which, as you can see from the accompanying chart, is just a blip compared to where the Fed had rates ten years ago.

The bigger news is the announced intention to raise rates three times next year, and move rates to a “normal” 3% by the end of 2019—which is faster than some anticipated, although still somewhat conservative from a historic perspective. Whether any of that will happen is unknown; after all, in December 2015, the Fed was telegraphing two and possibly three rate adjustments in 2016, before backing off until now.

The rise in rates is good news for those who believe that the Fed has intruded on normal market forces, suppressed interest rates much longer than could be considered prudent, and even better news for people who are bullish about the U.S. economy. The Fed may have been the last remaining skeptic that the U.S. was out of the danger zone of falling back into recession; indeed, its announcement acknowledged the sustainable growth in economic activity and low unemployment as positive signs for the future.

The longer term impact to stocks and bonds may depend on the pace of future increase. Historically, aggressive rate hikes have put pressure on bond prices whereas bond values seem to hold their own in slower increase cycles. Stocks, on the other hand, tend to be more driven by future economic growth. Rising interest rates can have a slowing impact on economic growth, but on the other hand they can also serve as a means of softening rapid expansion and keeping the economy in a health state. This is one of the overarching strategic objectives of the Fed.

The bottom line here is that there is no reason to change your investment plan just because you hear the Fed has raised rates. There is always too much uncertainty about the future to make accurate predictions, especially in these politically volatile times. At Kaizen we continue to monitor your portfolios and make strategic decisions based on long-term planning and investing. We worry about this so you don’t have to.

Sources:

Bob Veres, “CA – 2016-12-55 – Fed Funds Hike” (12.15.2016)

http://www.businessinsider.com/fed-fomc-statement-interest-rates-december-2016-2016-12

http://www.marketwatch.com/story/fed-to-hike-interest-rates-next-week-while-ignoring-the-elephant-in-the-room-2016-12-09

http://www.reuters.com/article/us-usa-fed-idUSKBN1430G4

http://www.usatoday.com/story/money/personalfinance/2016/12/15/fed-rate-hike-7-questions-and-answers/95470676/?hootPostID=32175354f7440337d62a767b3db92c68