Tax Reform Proposal

Submitted by Kaizen Financial Advisors, LLC on November 10th, 2017

Tax reform is something that has been talked about for a long time and as of last week we got a barebones outline of the proposal. Let’s take a look and see how the most recent House proposals might impact you come tax time.

The House bill consolidates our current 7 brackets in to 4:

- 12% (on the first $45,000 of taxable income for individuals; $90,000 for married couples filing jointly)

- 25% (starts at $45,000 for individuals; $90,000 for married couples)

- 35% (starts at $200,000 for individuals; $260,000 for married couples)

- 39.6% (starts at $500,000 for individuals; $1 million for married couples)

- Currently there are 7 tax brackets; 10%, 15%, 25%, 28%, 33%, 35% and 39.6%.

The current bill almost doubles the standard deduction: From $6,350 to $12,000 for singles; and increase the deduction from $12,700 or $24,000 for those filing jointly. This should reduce the number of people who itemize their deductions.

The plan eliminates personal exemptions which today allowed a $4,050 personal exemption for yourself, your spouse and each of your dependents.

A benefit for families is the expansion of tax credits for families called the Family Credit. This bill increases the child tax credit from $1,000 to $1,600 for any child under 17. It also creates a new $300 tax credit for each parent and non-child dependent. Remember a credit is not a reduction to income but a dollar for dollar reduction of taxes assessed, even if it results in a refund.

The bill also repeals state and local tax deductions, but preserves the property tax deduction up to $10,000. It limits deductible mortgage interest for current existing mortgages. But it reduces it for mortgages on newly purchased homes going forward. Mortgage Interest would be deductible for interest expense up to $500,000, which is down from $1 million limit today.

It is estimated that the percent of tax payers who would claim a mortgage interest deduction would fall considerably due to the doubling of the standard deduction. Remember, only people who don’t itemize can claim standard deductions, so the changes to the standard deduction will reduce the number of people who itemize.

Many savers are breathing a sigh of relief as 401(k) plans are not being changed. The House did not propose lowering the cap on pre-tax contributions which stands at $18,000 today.

The plan repeals the Alternative Minimum Tax which generally impact tax payers making between $200,000 and $1 million.

A major part of the plan eliminates the estate tax. The estate tax today affects only a small number of estates. Those with more than $5.5 million in assets (or $11 million if you leave a spouse behind). It looks like the repeal will be delayed 2024, and in the meantime will double the exemption levels.

The plan would also limit the maximum tax rate for pass-through business entities like partnerships and LLCs to 25%, which might allow high-income business owners to take their gains through the entity rather than as income and avoid the highest personal brackets.

Finally, the tax plan would lower America’s maximum corporate (C-Corp) tax rate from the current 35% to 20%. To encourage companies to repatriate profits held overseas, the proposal would introduce a 100% exemption for dividends from foreign subsidiaries in which the U.S. parent owns at least a 10% stake, and imposes a one-time “low” (not specified) tax rate on wealth already accumulated overseas.

Who are the winners and who are the losers? Big picture, economists are in the early stages of debating how much the plan might add to America’s national debt. One back-of-the-envelope estimate by a Washington budget watchdog estimated that the tax cuts might add $5.8 trillion to the debt load over the next 10 years. According to the Committee for a Responsible Federal Budget analysis, Republican economists have identified about $3.6 trillion in offsetting revenues (mostly an assumption of increased economic growth), so by the most conservative calculation the tax plan would cost the federal deficit somewhere in the $2.2 trillion range over the next decade.

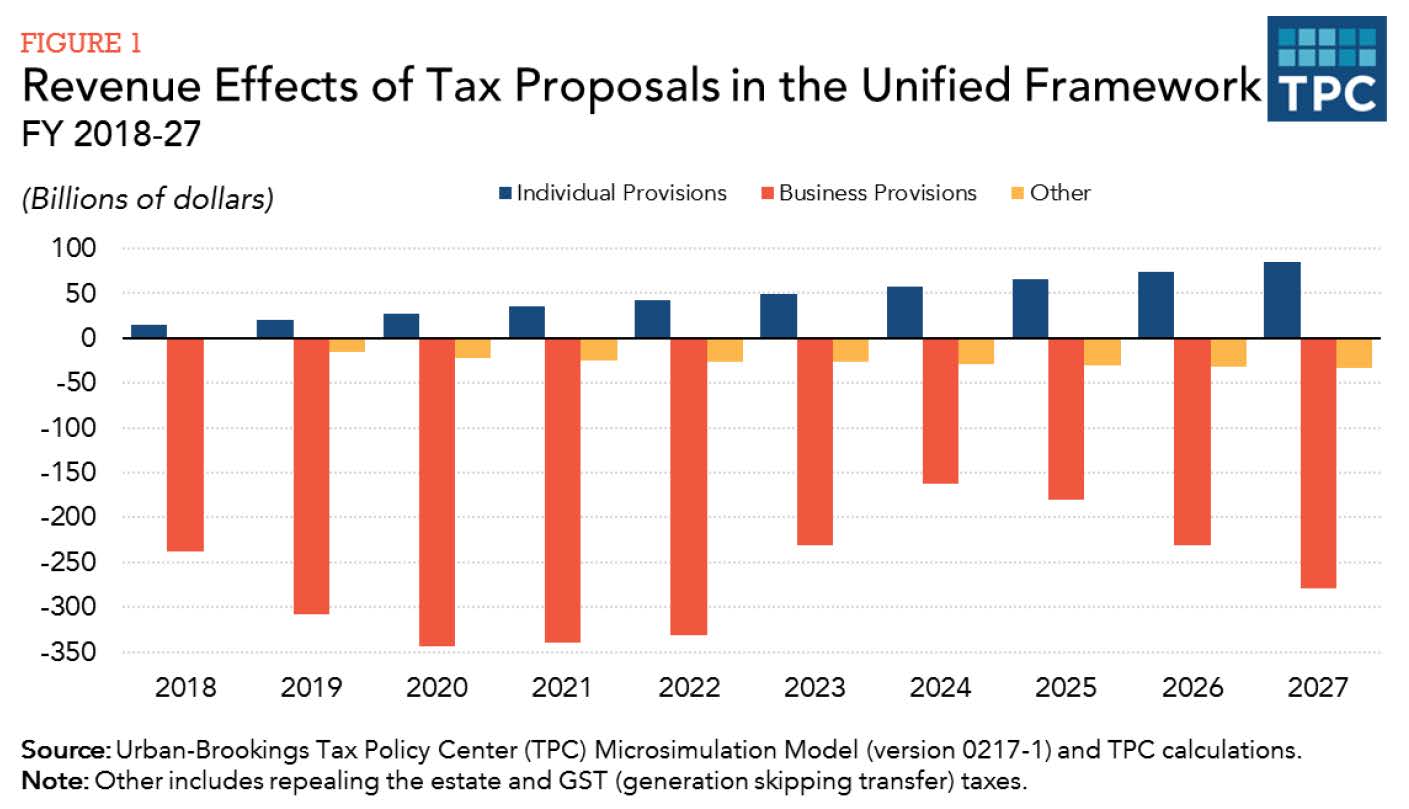

Others, notably the Brookings Tax Policy Center (see graph) see the new proposals actually raising tax revenues for individuals (blue bars), while mostly reducing the flow to Uncle Sam from corporations.

These cost estimates have huge political implications for whether a tax bill will ever be passed. Under a prior agreement, the Senate can pass tax cuts with a simple majority of 51 votes — avoiding a filibuster that might sink the effort — only if the bill adds no more than $1.5 trillion to the national debt during the next decade.

That means compromise. To get the impact on the national debt below $1.5 trillion, Congressional Republicans might decide on a smaller cut to the corporate rate, to something closer to 25-28%, while giving typical families a smaller 1-percentage point tax cut. Under that scenario, multi-national corporations might be able to bring back $1 trillion or more in profit at unusually low tax rates, and most families might see a modest tax cut that will put a few hundred extra bucks in their pockets.

Alternatively, Congress could pass tax cuts of more than $1.5 trillion if the Republicans could flip enough Democratic Senators to get to 60 votes. The Democrats would almost certainly demand large tax cuts for lower and middle earners, potentially lower taxes on corporations and higher taxes on the wealthy.

This bill has a long way to go and there are likely to be many negotiations and changes before it is finalized. Keep in mind, tax planning is an integrated part of Kaizen’s planning process. As such, we are staying up to date on the potential changes and how it would impact your financial plans and what adjustments (if any) we would need to make.

Sources:

https://www.yahoo.com/finance/news/trump-overpromising-tax-cuts-20501301...

https://www.aei.org/publication/the-big-six-tax-reform-framework-can-you...

https://www.washingtonpost.com/blogs/plum-line/wp/2017/09/27/trumps-new-...

https://www.yahoo.com/finance/news/hidden-tax-hikes-trumps-tax-cut-plan-...

https://www.yahoo.com/finance/news/republicans-700-million-problem-could...

https://www.yahoo.com/finance/news/trumps-tax-plan-just-got-180000645.html