Volatility is Back

Submitted by Kaizen Financial Advisors, LLC on December 28th, 2018

Summary of this week’s letter:

- Volatility is up and likely to persist

- Market downturns are frequent and common

- How we invest to weather all market conditions

- Reiterating the case for international exposure

Volatility Continues

After an abnormally calm 2017, volatility is back and it’s likely to stick around for a while. Let’s take a closer look at some of the major sources of global uncertainty which has been driving the recent market volatility and downturn:

- Monetary policy normalization in US and abroad: The Federal Reserve will increase interest rates to find the level of economic neutrality. The consensus seems to favor a relatively soft landing with the target Fed funds rate between 2.75% and 3%.

- Trade, Tariffs and the protection of national trade interests: The consensus expectation seems to suggest some escalation in the trade war which will likely shave 0.3% to 0.5% from global economic output. The US and their trading partners have too much to lose to fully give in to the other side, so expect tensions to continue.

- Instability of the Chinese Economy: There is a belief that monetary and fiscal easing will support China’s domestic demand and financial stability will ultimately be maintained, but for now concerns prevail. The likely outcome is moderate Chinese growth between 6.0% and 6.3% for 2019. Slower than previously expected, but still higher than the developed economies.

- Italy-Euro breakup risk. Tensions have been ratcheting up and Italian resentment is escalating. The Italian government may ultimately revise their fiscal policies to regain compliance with the EU requirements. This will diminish breakup concerns moving forward.

- Emerging market debt crises. The combination of global monetary divergence, the US dollar strengthening, as well as changes in global commodity demand has contributed to emerging market debt instability. There is a general feeling that problems will be contained to isolated cases and will not spread to become a more material threat. As a side note, most consider that EM stocks are now on sale, proceed with caution as the ride will likely be bumpy.

- US Government Shutdown. Last Friday, at midnight, the U.S. government shut down for the third time this year. This shutdown closed about a quarter of federal offices and nine agencies have begun to implement contingency plans as the timing of any resolution remains uncertain. Recent history suggests that a resolution will come quickly but it is not clear how things will play out this time around.

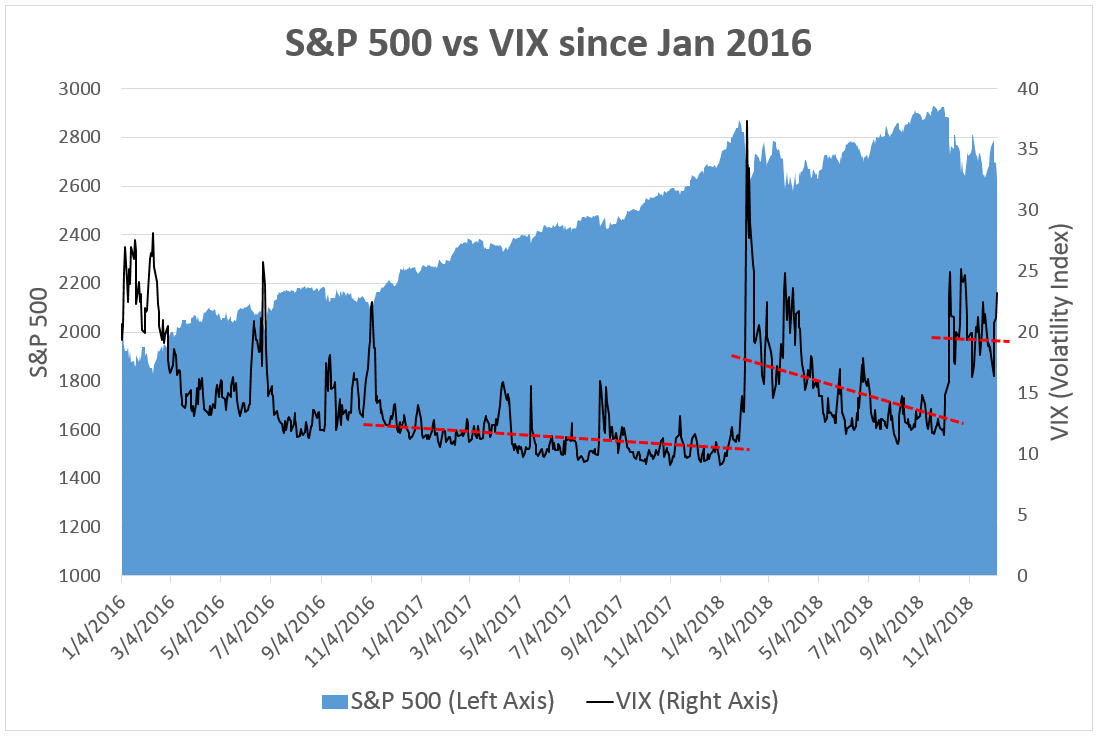

When uncertainty increases, so does volatility. This increase feels even more pronounced since 2017 was characterized by the lowest levels of volatility on record (see chart below).

Source: “Vanguard economic and market outlook for 2019: Down but not out”, Vanguard Research, December 2018 and Yahoo Finance for daily S&P 500 and VIX data.

Continued Economic Growth After the Bull Market

While we have likely seen both peak economic and earnings growth, an economic recession does not seem likely in the near term and profits look set to continue growing into next year, albeit at a slower pace.

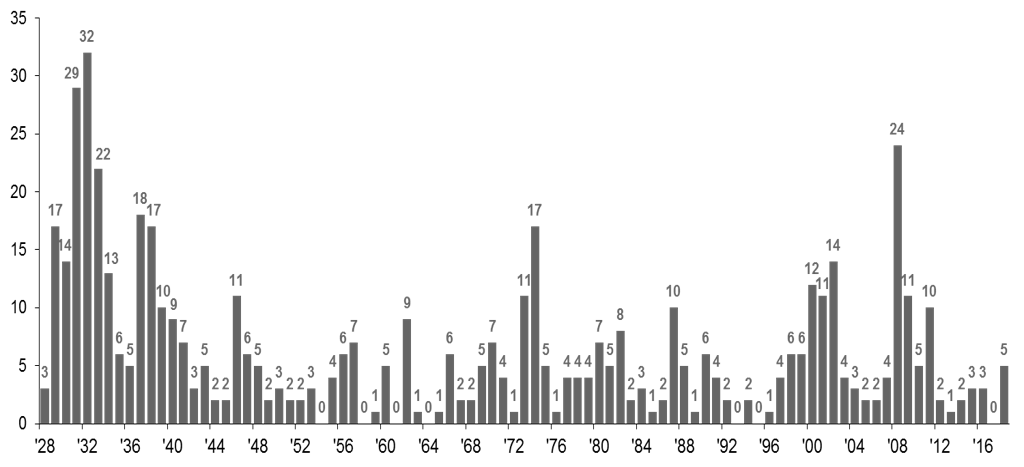

Times like these require a bit of an iron stomach and a little bit of perspective. The S&P 500 has fallen by an average of 14% intra-year over the past 38 years. Ironically, in 29 of those 38 years, the stock market finished the year in positive territory. The point is that moderate pullbacks happen frequently.

Chart: Number of 5% pullbacks in the S&P 500 experienced per year

Source: Standard & Poor's, FactSet, J.P. Morgan Asset Management. For Illustrative purposes only. Returns are based on price index only and do not include dividends. Data are as of 10/24/2018.

Additionally, it is important to remember that over the past 20 years, 6 of the 10 best days have occurred within two weeks of the 10 worst days. In 2015, the best day for the market (August 26) occurred just two days after the worst day (August 24). Sticking to your plan when the outlook is bleakest is often the best decision.

The Good News in the Markets

Despite the painful gyrations in the markets, there is optimism in the data. Consider the following facts: Corporate profits grew at an excess of 25% throughout 2018 with future expectations of 8% for 2019. The risk of recession during 2019 is still considered to be very low. From a valuation standpoint, earnings growth coupled with the recent 15% market pullback has lowered the S&P 500’s forward P/E to well below its long-term average. Capital spending has remained strong throughout 2018, with expectations for continued strength into next year. Consumer confidence, although off its peak, is still near 20-year highs. Consumer spending continues to be strong, evidenced by the nearly 5% year-over-year growth in Christmas sales. Unemployment remains near record lows. Oil prices have dropped 40% over the past couple months which will lower expenses for businesses and individuals in the new year. Expectations suggest that inflation will remain in-check for the next several years. The fundamentals of US economy remain strong despite the recent movements in stock market, and long-term, markets are driven by the economy.

What Kaizen is doing to protect your portfolio

Historically over long periods of time, taking higher risk, generates higher returns, with the caveat you must be able to withstand more gyrations in the market. The key to proper portfolio construction is to align risk with your investment time horizon, which we help our clients do.

For example, if you have more time to remain invested, you can generally take on more risk, but if you need the funds near term, it wouldn’t be prudent to put that money in the stock market. For perspective, on average it takes a 100% stock portfolio 3.6 years to fully recover from a bear market. Compare this to a more conservative allocation of 60% Stock, 40% Bond portfolio, which typically recovers in about 2.2 years.

Since we know timing the market perfectly is about as likely as winning the lottery, then the key to managing risk is to construct portfolios within the investor’s capacity to ride out the ups and downs. At Kaizen we talk a lot about buckets. Specifically, two buckets with different goals. Bucket 1 is your “safety” bucket and invested in securities like money markets, CDs and high-quality bonds. Bucket 2 is your “beat inflation” bucket where money is invested for the long term. It’s your hedge against living a long life (longevity risk). Bucket 2 is invested in domestic and international stocks as well as REITs. If you are in retirement you currently have 3 or more years of near-term withdrawals residing in your safety bucket. This gives you the capacity of allowing bucket 2 to splash around without having to change your lifestyle.

For younger clients that are still in the accumulation phase, the silver lining of down markets is that you are buying stocks on sale. Imagine eyeing a cool sweater at the mall. On Wednesday it costs $100. Now over the weekend the price has been slashed to $80, you are ecstatic. We should treat bear markets the same way, as we buy stocks on sale.

Opportunities from International equities’ underperformance

Kaizen portfolios allocate a portion of client investments in companies located outside the US. For the past several years these equities have underperformed their domestic counterparts. In fact, we have now entered the longest duration where US stocks have outperformed international.

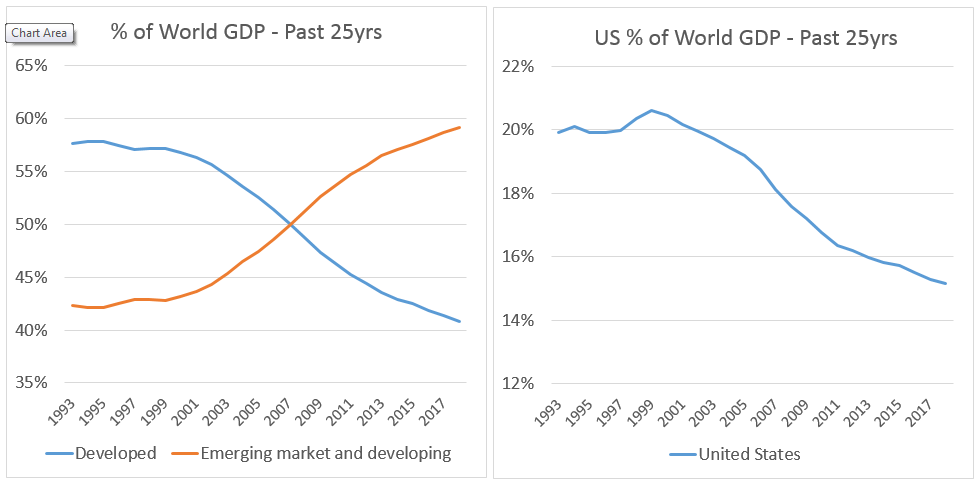

However, portfolios with international equities have historically had increased return and decreased risk. Many times international equities zig when domestic equities zag. From the time period from 2000-2010 the S&P 500 return was zero. If you had a diversified portfolio that included international equities your portfolio returned just shy of 5%. Furthermore, the majority of global economic activity occurs outside the US. Today, emerging and developing economies represent over 59% of World GDP, while the percent of World GDP coming from the US had been steadily declining.

Source: GDP data source is the International Monetary Fund IMF DataMapper database using purchase price parity (PPP) derived values.

In fact, most financial institutions predict that international equities will outperform US equities over the next 10 years. We believe these are compelling reasons to continue to have exposure to international equities within our portfolios.

Regardless of where the markets are heading, we want to be in communication with you. So be sure to check your email regularly as we will discuss relevant major developments. We want you to feel confident that you are on the right track at all times. If you have any questions or just want to check in, please don’t hesitate to reach out to your Kaizen Advisor.

Disclaimer: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Kaizen Financial Advisors, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.