What's Behind the Recent Market Sell-Off?

Submitted by Kaizen Financial Advisors, LLC on October 22nd, 2018

Stocks took it on the chin last week. The S&P 500 Index and Dow Jones Industrial Average each fell by just over 4%, and the NASDAQ lost 3.7% representing their worst weekly performances since March. Stocks began losing ground as the yield on the 10-year US Treasury spiked, helped by comments from US Federal Reserve (the Fed) Chair Jay Powell, who suggested that the Fed could continue to raise rates before finishing its cycle. Other news that contributed to market skittishness included fears of an overheated US economy, tariff impacts on corporate profits, China’s slowing growth, and nervousness around US equity valuations. Let’s dig a little deeper into each of these concerns.

Is the Fed being too aggressive with interest rates?

Relative to past cycles, the Fed has increased interest rates at a slower rate than the past. However, higher than expected inflation could motivate the Fed to be more aggressive, but we are not seeing a concerning trend at this stage. The Fed needs to control potential asset bubbles and leverage in the system to maintain financial stability, which is why sticking to the rate hiking path appears appropriate.

Is the US economy overheating?

The US economy is strong, but there does not appear to be evidence of overheating. Unemployment is at record lows but so far it has not translated into excessive wage inflation. Headline inflation, as measured by CPI, remains in check, increasing at a year over year rate of just 2.3%. That said, the impact of increasing oil prices and tariffs remain an inflationary threat going forward. There is wide spread belief that Gross Domestic Product (GDP) will slow somewhat over the next year. This may serve to temper the Fed’s intervention to slow it down.

What about the impact of tariffs on profits?

As a percent of GDP, foreign trade is among the lowest of all countries, which provides some protection against trade war impacts. So far company profits remain strong and do not appear materially impacted by tariff activity. It’s anticipated that earnings will hold up in Q3 at roughly 26% year over year earnings per share growth, largely driven by the tax cuts, a one-time shot in the economic arm. There is uncertainty around how this might change if the trade war continues to escalate.

Is China’s growth slowing too much?

China is struggling with several factors which could slow their economic growth such as slower global growth, excess-capacity, and deleveraging. China’s centralized government has taken actions to combat these issues. Specifically, they have injected capital via reductions in institutional reserve requirements and provided tax cuts. The Shanghai composite remains in a bear market YTD and near the year’s lows.

Are US stock valuations excessive?

S&P 500 companies are trading a little above their 25-yr average valuations (16.8x forward earning vs the 25yr average of 16.1x). Incredibly strong earnings have been driven by record profit margins and a fast-growing economy which may be difficult to sustain in the future.

Specifically, what happened last week?

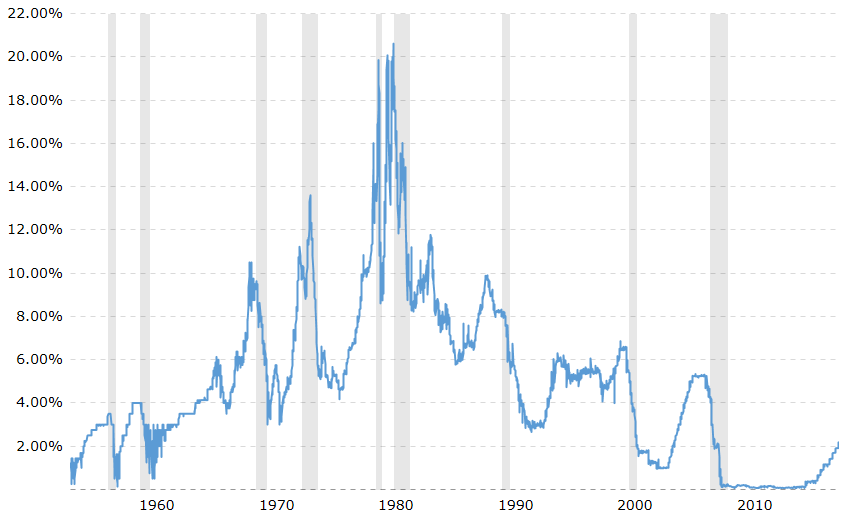

The answer is probably a little of everything, but the straw that broke the camel’s back seemed to be the rapid increase in interest rates. Over the past 13 months, rates have been rising with the 10yr treasury yield increasing from 2.1% to 3.2% - a third of that increase came in just the past 6 weeks. Rising interest rates slows the economy and causes weakness in stock prices because of higher borrowing costs that ultimately erode profits. Prolonged rate increases have frequently proceeded recessions, which is another concern. (See Fed Funds Rate chart below, shaded areas depict recessions).

Chart Source: https://www.macrotrends.net/2015/fed-funds-rate-historical-chart

The recent stock market volatility illustrates again why it’s important for our clients to remain disciplined and diversified in a way that’s consistent with their risk tolerance and investment goals. The bull market may have still have legs, and upside surprises are possible, but risks and uncertainty have been rising. Contact us if you want to discuss your specific situation in more detail.